Featured

Table of Contents

Consumers who enlist in the AMP program are not eligible for time payment plan. Web Energy Metering (NEM), Straight Gain Access To (DA), and master metered customers are not currently eligible. For consumers preparing on moving within the following 60 days, please put on AMP after you've established solution at your new move-in address.

Governments and institutions use these mercy programs to promote occupations in markets that supply public solution however may not give wages. Examples include training in poorer areas or exercising medicine in inner rural areas. One vital aspect of debt mercy connects to tax obligation standing. The basic policy for the IRS is that forgiven financial obligation revenue is taxed.

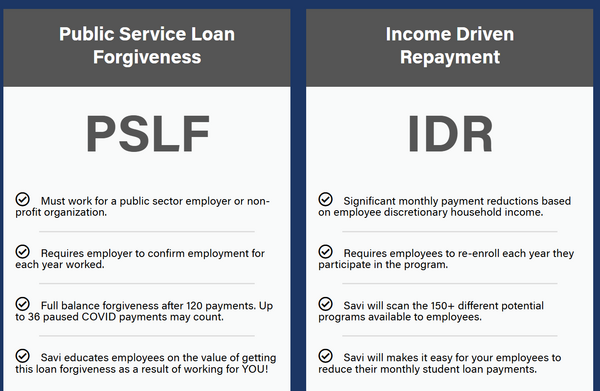

The PSLF program is for consumers that are utilized full time in qualifying public solution tasks. You would need to be eligible when you have actually made 120 certifying settlements under a certifying payment strategy while helping a qualifying employer. When you have actually met this need, the equilibrium on your Direct Car loans is forgiven.

The 10-Second Trick For Regulatory Changes Impacting Bankruptcy Availability

This is to motivate teachers to offer in areas where they are most needed. IDR strategies to adjust your regular monthly student finance settlement quantity based on revenue and household dimension. Any kind of impressive equilibrium is forgiven after 20 or 25 years of eligible settlements, relying on the certain picked actual plan.

Throughout the COVID-19 pandemic, the united state federal government implemented temporary relief steps for its federal student loan borrowers. The CARES Act suspended car loan settlements and established rate of interest at 0% for qualified federal trainee financings. It was seen as a short-term relief step, it was not lending forgiveness. Private pupil finances can not be forgiven under the government loan forgiveness programs since they are issued by exclusive lending institutions and do not lug the support of the federal government.

Paying off might entail a lower interest rate or even more manageable month-to-month settlements. Good credit score is needed, so not all customers may qualify.

Everything about Important Things to Ask a Debt Relief Organization

Some personal lenders use case-by-case hardship programs. These include briefly making interest-only repayments, briefly minimizing settlements below the contract price, and also various other types of holiday accommodations.

Some of the debts forgiven, specifically acquired from debt settlement, likewise negatively impact debt scores. Frequently, the dispute concerning financial debt forgiveness concentrates on its lasting effects.

Mercy of large quantities of financial obligation can have significant monetary ramifications. It can add to the public debt or require reallocation of funds from other programs. Policymakers, as a result, need to balance the prompt straight advantages to some people with the total economic influence. There are disagreements that debt mercy is not reasonable to those that already repaid their loans or followed less expensive paths of education and learning.

Understand that your car loans might be strictly federal, purely personal, or a mix of both, and this will factor right into your choices. Mercy or settlement programs can easily line up with your long-lasting economic goals, whether you're buying a home or planning for retired life. Recognize how the various kinds of debt alleviation might impact your credit rating and, later on, future loaning capacity.

The Of Recovering Personal Financial Standing the Right Way

Provided the possible tax effects, seeking advice from a tax obligation professional is a good idea. Debt forgiveness programs can be a genuine lifesaver, yet they're not the only method to deal with mounting financial obligation. These strategies adjust your government pupil lending settlements based on your revenue and family members dimension. They can reduce your regular monthly settlements currently and may forgive your remaining financial obligation later on.

2 means to pay off financial obligation are the Snowball and Avalanche methods. Both aid you focus on one debt at a time: Pay off your smallest debts.

Before choosing, believe about your own cash circumstance and future strategies. This method, you can make decisions that will certainly help your financial resources in the lengthy run. Canceled Debts, Foreclosures, Foreclosures, and Desertions (for People).

Unlike financial debt combination, which combines multiple financial obligations into a single lending, or a financial obligation management plan, which restructures your settlement terms, debt forgiveness straight lowers the primary balance owed. The continuing to be equilibrium is after that forgiven. You might pick to bargain a negotiation on your own or get the help of a debt negotiation firm or a seasoned debt assistance attorney.

Not simply anybody can obtain bank card financial debt forgiveness. You typically require to be in dire financial straits for lenders to also consider it. In certain, financial institutions take a look at numerous variables when taking into consideration debt forgiveness, including your revenue, possessions, various other debts, capacity to pay, and readiness to comply.

8 Easy Facts About The Benefits to Consider When Considering Debt Forgiveness Explained

In some situations, you might be able to settle your financial debt situation without resorting to insolvency. Focus on important costs to enhance your economic situation and make area for financial debt payments.

Table of Contents

Latest Posts

The 9-Second Trick For Building Your Custom Financial Recovery Roadmap

Innovation Is Making Financial counseling for veterans in Texas who are overwhelmed by credit card debt Easier Can Be Fun For Anyone

Non-Profit When a Business Fails: Personal Debt Strategies for Former Small Business Owners Programs Reviewed Things To Know Before You Buy

More

Latest Posts

The 9-Second Trick For Building Your Custom Financial Recovery Roadmap